The Newest Inflation Numbers Are In...And It Is Still Bad

The BLS have released October's CPI numbers and despite a slight decrease, inflation is still a menace.

The Bureau of Labor Statistics released October’s Consumer Price Index (CPI) and is reporting an increase of inflation by 7.7 percent year-over-year. This is .5 percent lower than September's 8.2 percent. Hopefully this downward trend continues as the record high inflation has been detrimental to the population. Many of the typical outlets have been quick in offering praise for the Federal Reserve’s action and commitment in raising interest rates to slow down inflation. But this is no time to celebrate. As Ryan McMacken of the Mises Institute writes “That’s the twentieth month in a row of inflation above the Fed’s arbitrary 2 percent inflation target, and it’s eleven months in a row of price inflation above 7 percent.” Continuing in his article, McMacken notes the real growth of average hourly earnings is -2.9 percent. Making the “nineteenth month in a row” of falling wages. Moreover, the praise means little as it was the loose monetary policy of 2020 and 2021 that led to this terrible situation.

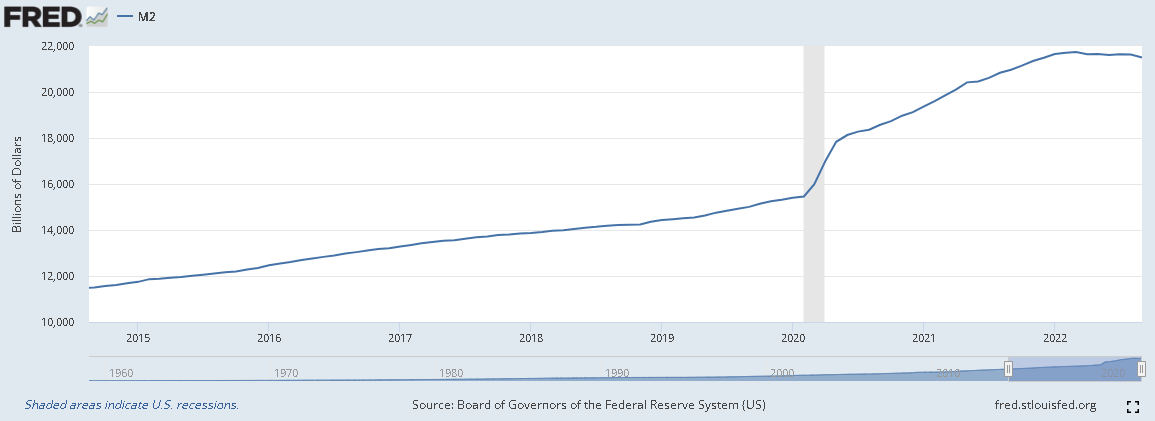

The cause for this record high inflation is due the record setting increases of the money supply during the lockdowns of 2020 and 2021. According to M2, the money supply has grown by 39 percent from February 2020 to September 2022. As we know, any increase in the money supply results in prices being higher than they otherwise would have been. And since price inflation takes time to permeate through the economy viz. cantillon effects, it is clear we are experiencing this from the extreme money printing of 2020 and 2021. The money supply continues to grow but at a slower rate.

Many pundits are wrong to argue that other variables. such as greed and supply shocks. are the primary drivers of this insidious inflation. In his article, which gained circulation among several popular sites, the server’s own J.W. Rich thoroughly knocked down the myth of corporate greed as a cause. The supply shocks are another popular scapegoat. Although no one talks about the cause of the supply shocks (i.e., state mandated lockdowns preventing business from occurring); they are quick to blame the shocks. It is true that supply shocks can cause prices to rise in the short run. And this most certainly did occur. For example, the automotive industry. But in a typical supply shock prices would soon enough fall as the issues get resolved and people adapt. With much of the world economy having opened up for some time now, the only higher prices we would see would be in specific industries. There wouldn’t be the universal and sustained increase we are currently experiencing.

Articles Like This One:

How to Buy Gold and Silver the Easy Way

The Car Market has Lost Its Mind

Discover New Opportunities

Click here for the Austrian Economics Discord Server.

Click here for the Austrian Economics Discord YouTube Channel.

Click here to get your very own “HA Academy” premium T-shirt for only 35 smackers! Available in 3 different colors.