Car prices have exploded over the past two years. This can be seen by the data, which shows a 40.5% increase in used cars and truck prices and 12.2% increase in new car prices from January 2021 to January 2022 (BLS Jan 2022). Furthermore, prices of automobiles have only continued to rise. To illustrate the absurdity—in 2019 a brand-new Volkswagen GTI started around $28,000. And now, a brand new GTI (2022/23) starts at $40,000 for a base model, with no wiggle room to negotiate on price. Meanwhile, a used 2019 GTI, with 25k miles and similar trim, now costs roughly $32,000 and has no warranty. Normally, a four-year-old GTI with low miles would be between $18-$25k. Unfortunately, the post lockdown era has caused prices to jump the shark. The GTI has always been the gold standard in affordable sporty hot-hatches, but is by no means a $40,000 car. Traditionally (as in two years ago), the $40k range would land you a brand-new Volkswagen Golf R, which sports 315hp (87 more than the GTI), all-wheel-drive, and a premium interior. The R towers over the GTI as a platform. But given that GTIs have traditionally (for decades) has been in that mid-to-high $20k range brand new, it’s a fantastic car and is at the top of its class.

One reason why automobile prices are absurdly high is a result of locking down the economy for two years. The lockdowns disrupted the structure of production causing a shortage of new vehicles, with the lack of computer chips being the main scapegoat. Because production takes time, when this process is disrupted, say by mandates, this forces the process to be prolonged and either completed at a time more distant into the future or abandoned completely. One of the unintended consequences of “pausing” the economy was dissolving the daily routines of employees, who then sought other means of income. Ultimately taking talent away from the production process prolonging production even further as companies scurry to find replacements in the currently tight labor market. Meanwhile, although the demand for vehicles plummeted during the first phase of the lockdowns and the supply of new vehicles practically nonexistent; it seemed to skyrocket right back to normal levels shortly after the PPP loans and stimulus checks were introduced (Fred 2022). With a lack of supply of new vehicles, buyers have been pushed into purchasing used vehicles (1-4 years old), driving those prices up as a result. Another noteworthy event, seems to be a doubling of repossessions shortly after this increase in demand, which may be cause for alarm. Perhaps due to a lack of income verification, an illusion of wealth due to high unemployment pay, and stimulus checks acting as down payments. Although, that is only speculative as of right now.

Another reason for absurdly high car prices is the recent unprecedented increase in the money supply. The money supply was increased by nearly 40% during 2020 causing prices now to be higher than they otherwise would have been (McMaken 2022). This is by far the largest increase in the money supply ever, with the money printing during The Great Recession of 2008 being a distant second. And because it takes time for prices to adjust, the wider population is now, a year-and-a-half later, reckoning with the consequences of a massive injection of newly printed money. With the consumer price index (CPI) being 9.1% as of June 2022, the BLS is calling this the “largest increase in 40 years” (BLS June 2022).

It definitely appears that this newly created money in combination with the shortage of supply as a result of lockdowns are major reasons for the absurdity of the current car market. As of right now it maybe best to hold off on purchasing a new/used vehicle if at all possible. At some point there will be an increase in supply and market correction. But that too takes time. For all the car enthusiasts out there, hang tight.

Works Cited

Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Consumer prices up 7.5 percent over year ended January 2022 at https://www.bls.gov/opub/ted/2022/consumer-prices-up-7-5-percent-over-year-ended-january-2022.htm

Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Consumer prices up 9.1 percent over the year ended June 2022, largest increase in 40 years at https://www.bls.gov/opub/ted/2022/consumer-prices-up-9-1-percent-over-the-year-ended-june-2022-largest-increase-in-40-years.htm

Fred. 2022. U.S. Bureau of Economic Analysis, Total Vehicle Sales [TOTALSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TOTALSA,

McMaken, Ryan. 2022. Money Supply Growth Fell Again in May as More Recession Alarms Ring. https://mises.org/wire/money-supply-growth-fell-again-may-more-recession-alarms-ring

Discover New Opportunities

Click here for the Austrian Economics Discord Server.

Click here for the Austrian Economics Discord YouTube Channel.

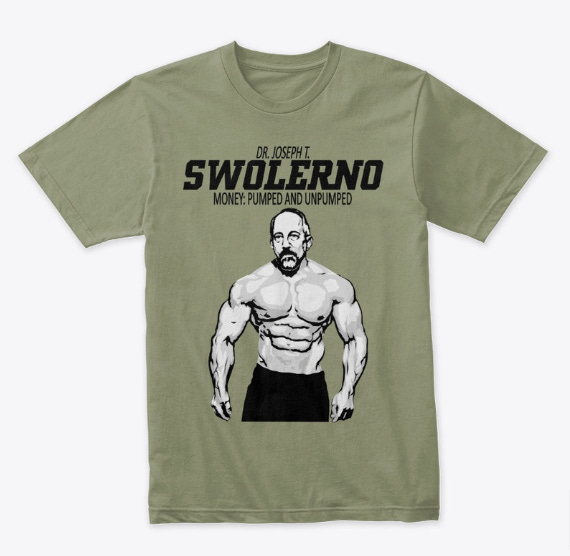

Click here to get your very own “Swolerno” premium T-shirt for only 25 smackers! Available in 3 different colors.