How Economics Became a Mathematical Science

A look into Gerard Debreu and his influence on the economics profession.

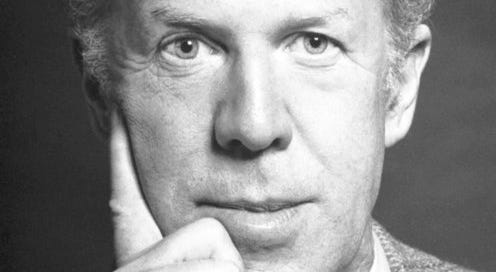

Many people argue the economics profession suffers from physics envy. The urge economists experience to approach economics in the same way physicists approach physics. Although there is some truth to this belief; economist E. Roy Weintraub argues, in his book How Economics Became a Mathematical Science, the approaches used in the economics profession more closely resemble those used in mathematics. Almost making economics a branch of applied mathematics. Weintraub accomplishes this by reviewing the history of thought of mathematics and then drawing connections to the economists who have majorly influenced the methods used in the profession. In fact, the vast majority of influential economists since the 1870s Marginal Revolution were trained as mathematicians prior to becoming economists. It was the mathematicians who came to economics. Not economists to mathematics. As a result, ever since, economics has been highly mathematical, with much debate among economists on how to apply math to economics. One such mathematician turned economist, who greatly influenced the economics profession, was Frenchman Gerard Debreu. In 1954 Debreu along with American Kenneth Arrow created a proof for a general competitive Walrasian equilibrium. In 1959 he published The Theory of Value, “which still stands as the benchmark axiomatization of the Walrasian general equilibrium model” (Weintraub 2002 p. 114). Debreu’s work was so influential that he won the 1983 Nobel Prize in economics for his mathematical approach. A heavy influence that still holds today.

Debreu’s approach to economics was heavily influenced by the Bourbakist school of mathematics. From the 1930s through the early 1950s the Bourbaki shared the same view on math that dominated American circles at that time. Viewing mathematics as “an autonomous abstract subject, with no need of any input from the real world, with its own criteria of depth and beauty, and with an internal compass guiding future growth” (Weintraub 2002 p.102). Despite producing a book “with the elegance and grace of a masterwork” and a coherence that “cannot be underestimated” the Bourbaki failed in creating a mathematics that was pure and rigorous from the ground up (Weintraub 2002 p. 108). Because the bedrock of their system relied on a vague concept of structures, which failed to provide the grounding that rival approaches in mathematics could offer. Thus, the pure and isolated approach of the Bourbaki fell out of favor. But not before influencing Debreu and indirectly the economics profession.

Debreu attempted to do for economics what the Bourbaki did for mathematics and met a similar result. Trained as a mathematician under the Bourbaki paradigm Debreu was dissatisfied with the economics profession’s lack of mathematical sophistication. This motivated him to approach economics with a similar rigor, purity, and self-containment that the Bourbaki attempted with math. For example, Debreu’s Theory of Value can be seen as a “direct analogue of Bourbaki’s Theory of Sets” (Weintraub 2002 p. 121). Debreu’s Theory of Value “shares many of the same problems of structures and “structures” experienced by Bourbaki” (Weintraub 2002 p. 123). Problems which Debreu and other economists Hugo Sonnenschien and Rolf Mantel would discover in the early 1970s. Like the Bourbaki relying on structures, Debreu’s work relied on Walrasian general equilibrium. The theorems which Sonnenschein/Mantel/Debreu (SMD) produced in the 1970s completely undermined Walrasian general equilibrium by demonstrating, on its own terms, it could not reliably explain how an economy reaches a stable equilibrium point. Unfortunately, due to the Cantillion Effects of Knowledge, the momentum and influence of Debreu’s 1950’s works and methodology continues to be influential despite being empty.

Debreu changed the economics profession with his pure mathematical approach. But the profession seems to have always be dominated by mathematicians. And as the old adage goes “If the only tool you have is a hammer, it is tempting to treat everything as if it were a nail.” Debreu’s approach is widely influential. But it is one-of-many mathematical approaches used in the economics profession. And currently there exist tensions between the two most popular approaches. The mathematical economists and the empirical economists. Debreu would be an example of a mathematical economist. Today, the empirical approach (i.e., econometrics) is becoming more and more popular, with mathematical economists slowly losing their dominance and prestige since the late 20th century. Unfortunately, with small exceptions such as the Austrians, the debate is limited to how to use math in economic theorizing as opposed to whether or not math should be used at all.

Works Cited

Weintraub, E. Roy. (2002). How Economics Became a Mathematical Science. Duke University Press.

Other Articles Like This One

What Economists Get Wrong About Marginal Utility

The Problem of Math in Economics

Discover New Opportunities

Click here for the Austrian Economics Discord Server.

Click here for the Austrian Economics Discord YouTube Channel.

Click here to get your very own “Swolerno” premium T-shirt for only 25 smackers! Available in 3 different colors.

A post that seems to subsume (quite rightly) Léon Walras’ place at the head of the marginalist revolution, might usefully provide his take on your theme of mathematics’ disproportional influence on economic science:

“In any case, the establishment sooner or later of economics as an exact science is no longer in our hands and need not concern us. It is already perfectly clear that economics, like astronomy and mechanics, is both an empirical and rational science. As for those economists who do not know any mathematics, who do not even know what is meant by mathematics and yet have taken the stand that mathematics cannot possibly serve to elucidate economic principles, let them go their way repeating that ‘human liberty will never allow itself to be cast into equations’ or that ‘mathematics ignores frictions which are everything in social science’ and other equally forceful and flowery phrases. They can never prevent the theory of the determination of prices under free competition from becoming a mathematical theory. Hence they will always have to face the alternative of either steering clear of this discipline and consequently elaborating a theory of applied economics without recourse to a theory of pure economics or tackling the problems of pure economics without the necessary equipment, thus producing not only very bad pure economics but also very bad mathematics.”

Léon Walras: preface to his Elements, 1877.

[Emphases are in the original.]

That said, please permit me to take issue with your assertion that . . .

“The theorems which Sonnenschein/Mantel/Debreu (SMD) produced in the 1970s completely undermined Walrasian general equilibrium by demonstrating, on its own terms, it could not reliably explain how an economy reaches a stable equilibrium point.”

Hugo Sonnenschein is more generally quoted (always without attribution) as saying that ‘the Arrow Debreu model cannot demonstrate the equilibrium that would emerge when agents make rational make rational choices in some institutional setting that in some way describes the key features of actual markets.’ (See Christian Arnsperger and Yanis Varoufakis, post-autistic economics review; Issue no. 38, 1 July 2006; article 1: “What Is Neoclassical Economics?” http://www.paecon.net/PAEReview/issue38/ArnspergerVaroufakis38.htm.)

For Sonnenschein’s own recollection of what he said, as well as where and when he said it, see file:///C:/01%20SFEcon/SFEcon%20Site/1_Discussions/12_SFEcon/125_Heterodox/1221_Declarations/Sonnenschein.png

Now: how, pray tell, does one does one DEMONSTRATE that something cannot be done? As asserted in my reply to “Learning Economics: Immature Learners” . . . https://austrianeconomics.substack.com/p/learning-economics-immature-learners?sd=pf

. . . Western science operates on the principle of contradiction: if you are saying something cannot be done, and somebody does, you change your mind.

The only possible reply to Sonnenschein/Mantel/Debreu is to create an objective demonstration of optimality arriving with equilibrium under the premises of neoclassical causation. If mathematics are forbidden in the creating of such demonstrata, then you are simply refusing to engage in a scientific discussion of how economic QUANTA come to be distributed among profit-seeking agents.