Europe Continues to Suffer from Massive Inflation

A snapshot look at Europe's current inflation problem and the reasons why.

By Rob Thorpe

Today we hear about inflation every day in the news - that's a stark difference to the past twenty years. Prices are rising all around the world. Consumer price inflation is high in nearly every country. Unfortunately, a great deal of what we hear is confusing. Much is written by people who don't have enough understanding of the subject.

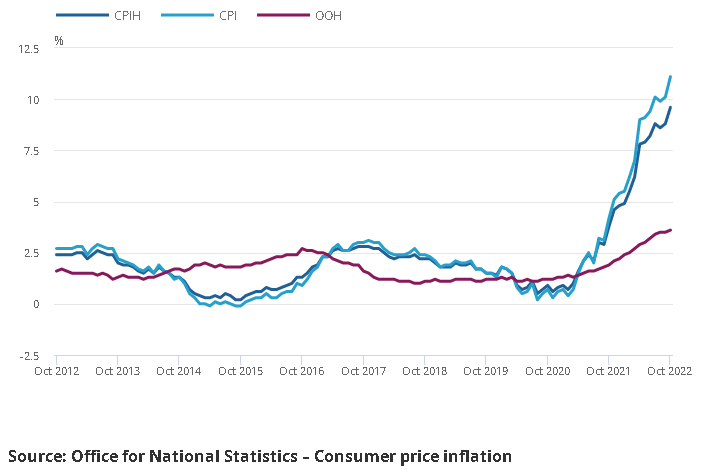

Today we'll look at price inflation in Europe. The CPI index for the UK rose by 11.1% between last October and this October. A similar figure for France is 6.2%. For Germany it is 11.6% using the harmonized EU index method and 10.4% using Germany's own method. The rate of increase of the Dutch CPI index is a huge 14.3%.

This topic is plagued with ideas that are too simple and also with ideas that are too complex. Some believe that price rises are all about money and nothing else - that is too simple. Others believe that price inflation is all about the supply of goods and nothing else. That idea is also too simple. Then there are the Mainstream economists who have very complex mathematical models of the situation. From time-to-time they try to cast those models into words. Usually nobody understands them. All that complexity is needed if your aim is to predict the exact value of a CPI index for the next quarter. Though, that is not a very realistic or sensible aim.

So, my task is to not to simplify too much or to complicate too much. There are three basic forces that determine the what you can buy with money. Each of these are not more or less important than the other, they're similar in importance. Number 1 is supply of goods and services. Number 2 is the supply of money. Number 3 is the demand for money.

Firstly, there is the supply of goods and services. This can vary for many reasons. If the supply of a good is suddenly reduced due to some unforeseen factor then the price of that good will rise. That's true assuming that the demand for that good does not simultaneously change. Such a change can't cause a constant increase in prices. There have been plenty of these supply shocks recently in Europe. The lockdowns enforced during the COVID pandemic caused disturbances to many industries. Lockdown related stoppages caused shortages of important products like silicon chips. Some of those problems linger on even today. Then there is the Russo-Ukraine war and the associated shortages of gas and oil.

Natural gas is the critical issue in Europe. It is much more important than oil because oil is fairly easy to transport internationally by tanker. For many years Europe has imported most of it's gas from Russia. That natural gas is used for home heating, in power-stations and in industrial processes. When Russia invaded Ukraine in February 2022 the European countries, the US and some others put sanctions on Russia. European countries reduced their purchases of Russian natural gas but did not stop them. Later on the Russian government itself began cutting exports. Then three of the four major Nordstream pipelines carrying gas to northern Europe were sabotaged. So, even if political will were to exist in Europe to resume large-scale imports from Russia it would not be possible until the pipelines are repaired. This has caused the price of gas in Europe to skyrocket. From June 2022 to August 2022 the price in the Netherlands per MWh rose from 83 euros to 339 euro. In other words, wholesale gas was made about 4 times more expensive than before. This has caused a rush of responses amongst governments. Many European national governments have begun subsidizing natural gas.

However, we must not be fooled into thinking that supply problems are the only issue. After all, the wholesale natural gas price in Europe has now dropped to 130 euros per MWh - it's now only ~57% more expensive than in June of 2022. Despite that prices are still rising fast. The money supply is important because the more money there is in circulation the more of it can be spent. So, an expanding money supply pushes prices upwards. A growing money supply will cause price inflation if there are no other complicating factors.

Jerome Powell became famous for his money printer - his liberal use of Quantitative Easing. Powell was not alone. His less famous European counterparts were doing much the same thing during the COVID lockdowns and well after they had finished in 2021. UK M1 money supply shows a similar pattern to US money supply. As the lockdowns began in early 2020 the Bank Of England began massive Quantitative Easing. Even after the lockdowns had mostly ended in 2021 the rate-of-increase of the money supply remained much higher than normal. Indeed, it hasn't fallen yet. The graph for the Eurozone is fairly similar. Though in the Eurozone the M1 money supply fell slightly in September.

The last factor is the demand for money. Think of money as a fraction of the assets that you own. At some times you may want to hold more money. Then perhaps you will save your wages or sell assets to achieve that. Selling assets for money won't increase your net worth, but it will increase the liquid portion of it. Similarly, at other times you may decide that you have too much of your wealth tied up in money. You may decide to spend some perhaps on consumer goods or perhaps on assets. When you are attempting to increase your holding of money you are "demanding" money in the economic sense. Changes in the demand for money add up across the whole economy. If most people's demand for money is rising that helps to prevent prices from rising. On the other hand, if most people's demand for money is falling that pushes prices up.

Unfortunately it's not possible to say much about this in terms of quantity. It's difficult to measure. Statistical agencies do offer some measures, but they're indirect and not comprehensive. These tend to show that money demand hasn't changed much since 2020 - though we can't be sure.

The Central Banks of Europe will raise interest rates to reduce inflation. This will succeed if they do it for long enough. This will inevitably cause pain for many businesses and borrowers. We should remember that this pain is happening in part because those Central Banks made mistakes. They stimulated too much money creation in 2020 and 2021. The interest rate rises have already contributed to a recession beginning in the UK, they could trigger recession in the rest of Europe too.

Articles Like This One:

The Best Books to Read to Learn Economics

The Newest Inflation Numbers are In…And It Is Still Bad

Discover New Opportunities

Click here for the Austrian Economics Discord Server.

Click here for the Austrian Economics Discord YouTube Channel.

Click here to get your very own “HA Academy” premium T-shirt for only 35 smackers! Available in 3 different colors.